cumulative preferred stock formula

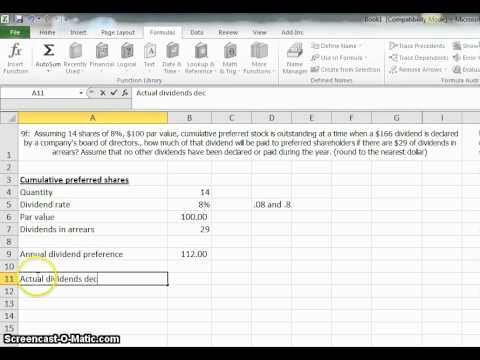

10 11 375000 100 8 Annual preferred dividend C14C11C12 Total dividend payment in 2022 Preferred stock par value Preferred dividend rate Cumulative preferred stock outstanding shares 12 13 14 10000 15. Cumulative Dividend 5 x 100 5 Dividend per preferred share.

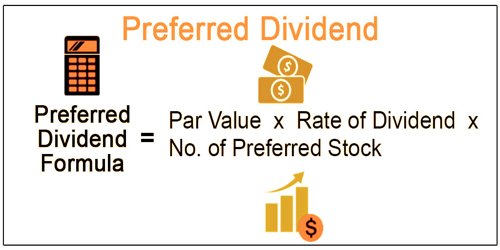

Preferred Dividend Definition Formula How To Calculate

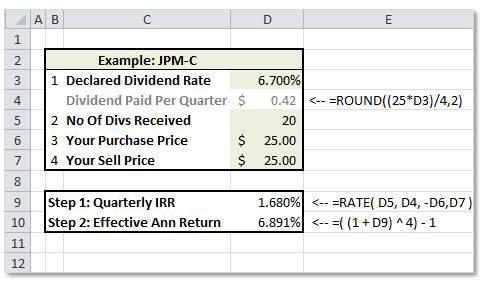

Annual Dividend Ratevalue at par Unless the payment frequency is quarterly each quarter the dividend paid would be.

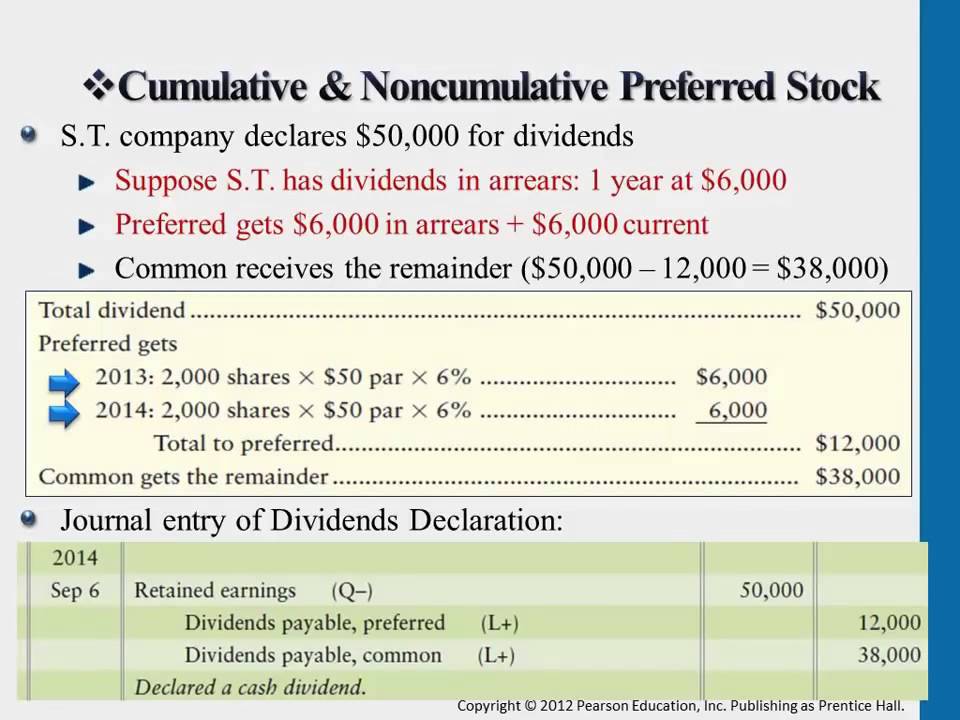

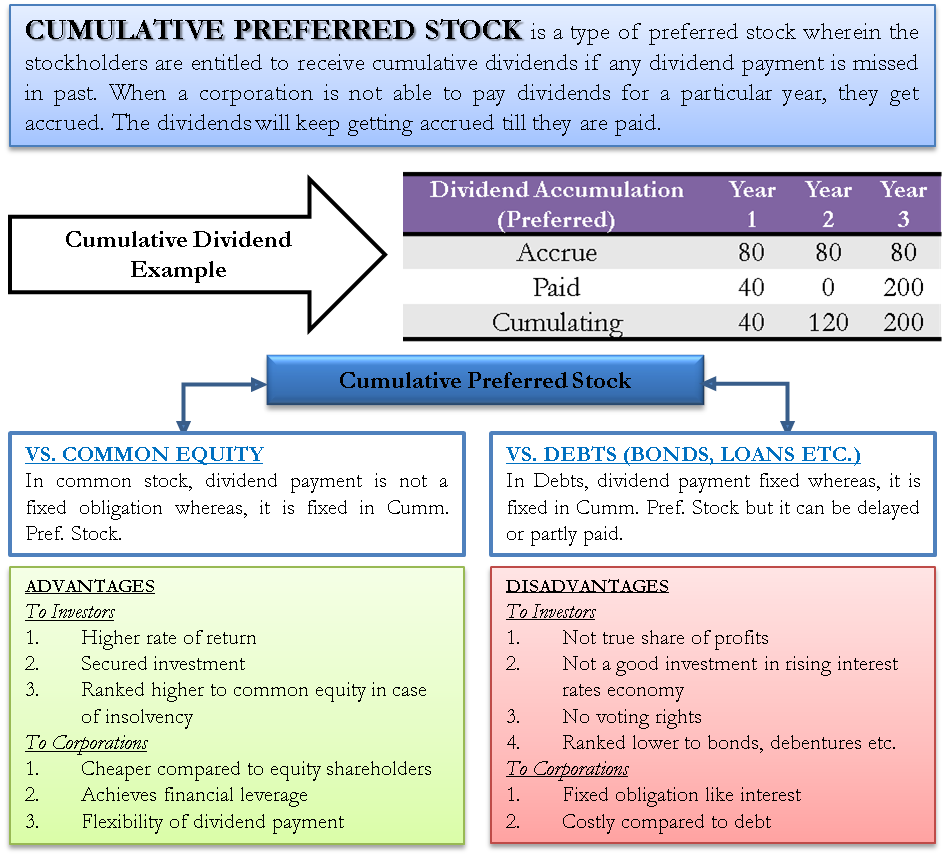

. Total Dividend Payed - Preferred CSD. To Cumulative preference shareholders there is an obligation to pay them the dividends but a relaxation that it can be delayed or being partly paidRather in any kind of Debt it is mandatory to pay interest fee in the accrual year. Suppose cumulative preferred stock with a 10 dividend rate and a 1000 par has been issued.

Use mathematical formulas with cell references to the Problem or work area as indicated. The remaining amount of 200000 can then be distributed among common stockholders. Cell Referencing Using Excel to Determine Dividends Paid to Common and Preferred Stockholders PROBLEM M.

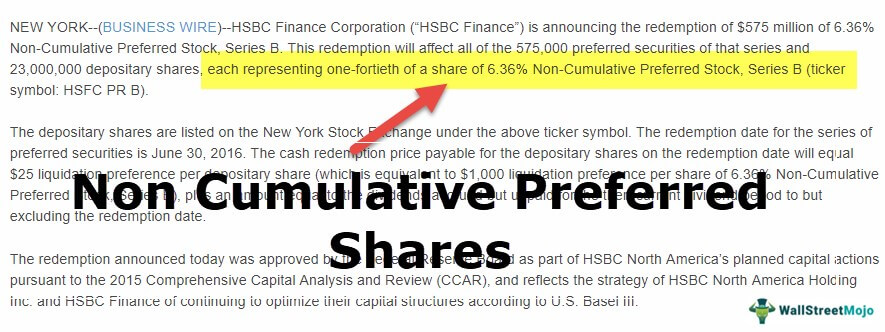

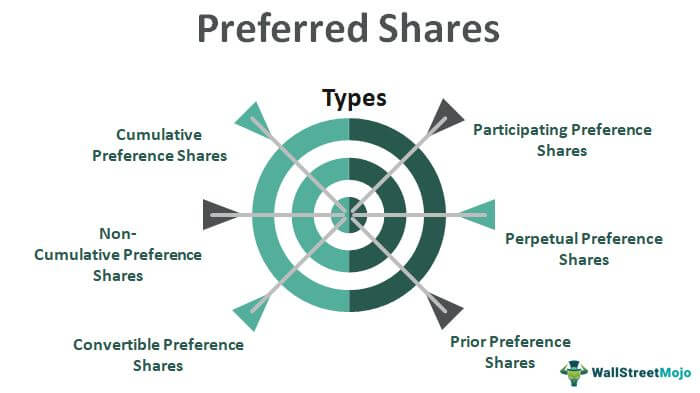

Cumulative preferred stock is a type of preference share that has a provision that mandates a company must pay all dividends including those that were missed previously to cumulative preferred. Cumulative preferred stock not only pays current dividends but it also must eventually pay out any suspended dividends. The preferred stock dividends formula is par value x dividend rate x position skipped dividends.

It has been determined that based on risk the discount rate would be 5. Print Cumulative Preferred Stock. The company calculates the dividend to be paid by multiplying the par value times the dividend percent.

Formula Examples Worksheet 1. Example 100 Shares of 10 5 Cumulative Preferred Stock. Cumulative preferred stock is a type of preference share that has a provision that mandates a company must pay all dividends including those that were missed previously to cumulative preferred.

Bot Corporation has common stock and cumulative preferred stock outstanding at December 31. The price the individual would want to pay for this security would be 20 divided by 055 which is calculated to be 400. This calculates the dividend rate per share.

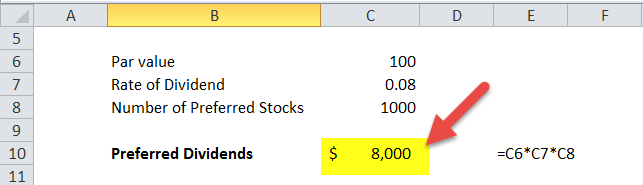

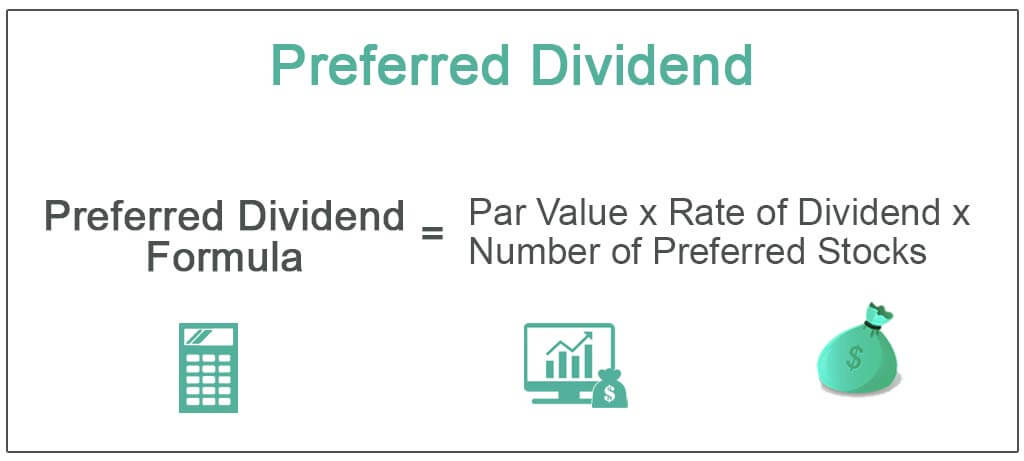

The basic two things to calculate the dividend are given. Preferred Dividend Formula Number of preferred stocks Par Value Rate of Dividend. When it is delayed the company may fall under bankruptcy logic.

If the current share price is 25 what is the cost of preferred stock. We know the rate of dividend and also the par value of each share. Cumulative Dividend Formula Preferred Dividend Rate Preferred Share Par Value Where Preferred Dividend Rate The rate that is fixed by the company while issuing the shares.

The dividend on cumulative preferred stock for current period is always deducted from net income while computing current periods EPS even if management does not declare any divided during the period. Rp D P0. They did not pay a Dividend for Year 1.

The company multiplies the dividend per share by the total number of preferred shares outstanding to determine the annual dividend amount to pay the preferred stockholders. In addition Lowry owes 200000 in dividends to the holders of its cumulative preferred stock. 100 008 1000 8000.

Formula for Cumulative Preferred Stock Dividends. The dividends on cumulative and non-cumulative preferred stock impact the computation of earnings per share differently. An individual is considering investing in straight preferred stock that pays 20 per year in dividends.

Perpetual Preferred Stock Price Fixed Dividend Dividend Yield. Print Cumulative Preferred Stock. It means that every year Urusula will get 8000 as dividends.

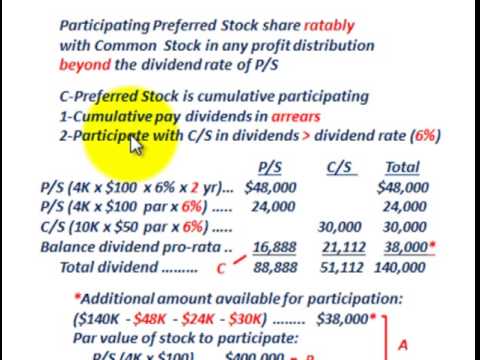

A company has preferred stock that has an annual dividend of 3. 8 9 What amount of dividends will common stockholders receive. The preferred stockholders must be paid 120 in arrears along with the current year dividend of 80.

Rp 3 25 12. In this case we have the rate of dividend and par value is given now we can calculate a preference dividend using the formula. If board of directors decides to pay a dividend of 1200000 in 2021 the cumulative preferred stockholders will be paid a total dividend of 1000000 5 per share for two years.

If Colin were to purchase 1000 preferred shares of ABC Company assuming that the preferred shares come with a cumulative dividend feature. A nonperpetual preferred stock will have a stated buyback price and buyback date usually 30. The cost of preferred stock formula.

Formula for Common Stock Dividends. A cumulative dividend is a. 500000 for 2020 500000 for 2021.

Once all cumulative preferred stockholders are paid 200 the company may begin to pay other shareholders. Preferred cumulative stock Vs Debt. Calculating cumulative dividends per share.

Dividends in Arrears Current Annual Dividend Amount to be Paid Each Year. For this reason the cost of preferred stock formula mimics the perpetuity formula closely. Following is the tabular expression of cumulative dividends in preferred.

For this reason the cost of preferred stock formula mimics the perpetuity formula closely. Preferred stocks usually pay dividends quarterly. If Colin were to purchase 1000 preferred shares of ABC Company assuming that the preferred shares come with a cumulative dividend feature payable once a year how much in dividends is he entitled to annually.

First determine the preferred stocks annual dividend payment by multiplying the dividend. In this case we have the rate of dividend and par value is given now we can calculate a preference dividend using the formula. Preferred Dividend Formula Number of preferred.

Preferred Dividend formula Par value Rate of Dividend Number of Preferred Stocks. Rp D dividend P0 price For example.

Retail Investor Org Nitty Gritty Ofpreferred Shares How They Work Investor Education

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Non Cumulative Preference Shares Stock Top Examples Advantages

Preferred Dividend Assignment Point

Preferred Shares Meaning Examples Top 6 Types

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Cumulative Noncumulative Preferred Stock Youtube

Common And Preferred Stock Principlesofaccounting Com

Cumulative Preferred Stock Define Example Benefits Disadvantages

How To Calculate Preferred Stock Outstanding The Motley Fool

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

How To Calculate Cumulative Dividends Per Share The Motley Fool

Preferred Stock Accountingcoach

Compute Preferred Dividend On Cumulative Preferred Stock With Dividends In Arrears Youtube

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Preferred Shares Meaning Examples Top 6 Types

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube